The benefit: open up additional profit potential.

An integrated group’s transfer pricing policy affects entrepreneurial decisions, performance measurement of both, management and affiliates, as well as the allocation of resources. Creating a documentation, therefore, generates insights useful to make the group more successful. Two cases demonstrate how groups can open up additional profit potential as a consequence of reviewing and adjusting the transfer pricing policy to the business needs. This, however, requires CFOs to consider transfer pricing not just as a tax exercise only.

The effort: document the transfer pricing policy

BEPS action 13 requires multinational enterprises to present intra-group cross-border transactions between affiliates and branches with tangible and intangible property, services and financial services in the context of their integrated value chains. Larger groups (in terms of consolidated sales) have to supplement their master file/local file documentation with a country-by-country reporting.

Develop profit potential through margin based product pricing

Integrated groups frequently employ some kind of cost plus methodology to arrive at (intra-group) prices for components, finished products, and services. The “plus” often reflects both, overheads and profits (total cost approach). As illustrated below, this pricing may have consequences such as:

- in fact lucrative markets are not served and/or

- available manufacturing capacity is not used to the extent possible and eventually reduced.

In any case, opportunities and risk were not fully assessed, and profit opportunities were not identified and pursued. Obviously, such potential would have been identified and developed using a variable contribution margin (or margin) based product pricing policy. Such insights – and not just a better understanding of the tax exposure – will be gained documenting the transfer pricing system according to the new OECD provisions. The management challenge – particularly the CFO challenge – is defining and taking actions to systematically develop such business opportunities.

Margin based pricing creates profit opportunities

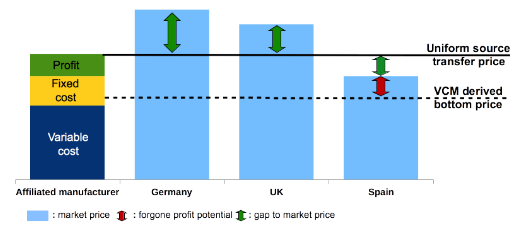

As part of its growth strategy a mid sized group considers supplying additional European (Germany, UK, and Spain) markets through local subsidiaries or branches. Based on a uniform ex-works product price the group expands into the German and UK markets (see Exhibit 1). Due to the too low local price level the Spanish market is not developed.

The documentation of the transfer pricing policy revealed that – given sufficient manufacturing capacity – supplying Spanish customers at the local price level still generates a variable contribution margin (see Exhibit 1). As a consequence, the group replaced the total cost based uniform ex-works-price with a margin based pricing and started developing the Spanish market. Generally, the ability to assess opportunities and risks was improved.

Margin based pricing ensures own manufacturing capacity’s utilisation

A 1sttier automotive supplier develops and manufactures components for OEMs (original equipment manufacturers). An affiliated plant offered a particular part. Often the affiliates offer was too expensive. The development team, therefore, nominated 3rdparty suppliers in order to meet customers’ targets. The affiliated plants capacity utilisation and profits declined.

The transfer pricing documentation revealed that the offer prices were determined using a total cost approach. Management decided to determine the prices based on the variable contribution margin. In future, the affiliated plant will accept the lowest competitive price provided it earns a variable contribution margin. In the long-run capacity utilisation and profits will increase.

In practice, margin based pricing is still a challenge

For many reasons, despite the perceived ERP and data warehouse power, cost and pricing information necessary may not be available when and where needed. However, two major reasons are to be considered specifically:

- the cost data available may not have the appropriate structure and/or reliability (e.g. budget data only, …);

- both, management and decision processes may rely on an individual company view instead of considering the integrated group’s entire value chain.

In the latter situation, realigning the management and decisions processes as to facilitate contribution margin based decision taking across the integrated value chain may require significant change management efforts.

Ensuring tax defensibility

Ideally, transfer pricing systems are tailored to the respective business’ needs and consistent with the allocation of functions and risk across the integrated group. In particular, the latter criterion is essential for ensuring the system’s tax defensibility.

At first glance, employing the cost plus method may be considered tax defensible in itself. This, however, requires that the manufacturing entity

- operates as contract manufacturer assuming fairly limited business risk and

- owns routine process intangibles;

- does not own any product intangible.

Otherwise, the cost plus derived uniform ex-works price may turn out to be inconsistent with the underlying allocation of functions and risk and create significant tax exposure. Such situation arises should an in-depth functional analysis reveal that:

- the entity dedicates significant resources to both, product and process R&D (→ ownership of product intangibles);

- its management takes major strategic decisions with respect to the group’s product range, the R&D conducted, and

- provides the funding required.

However, margin based pricing procedures suitable for business purposes are not tax defensible by default. Maximising the group’s integrated profit does not imply that each entities’ share in the overall profit complies with the allocation of functions and risk. Accordingly, group’s are well advised to regularly review and adjust their transfer prices. As a result integrated group’s may

- uncouple transfer pricing for business decisions and tax purposes;

- expand the use of outside evidence studies in order to comply with the arm’s length standard.