Abstract

The new OECD Transfer Pricing Guidelines concisely present the new tightened documentation requirements1. To align transfer pricing outcomes, i.e., the allocation of taxable income across the group companies, with the value creation (across the integrated value chain) is the revision’s overall objective2.

Generally, the transfer pricing documentation consists of Master file and local file. Groups with consolidated sales of more than € 750 Mio. are required to additionally file the country-by-country reporting (CbC) on an annual basis (first year: 2016 – last filing date: 31.12.2017 for the fiscal year 2016)3. The latter provides a high-level overview over the allocation of taxable income and resources across the various tax jurisdictions the group operates in. Differences between the allocation of taxable income and resources should be explained / justified through the Master File / Local File details.

Basically six work steps are required to comply with the new documentation guidelines:

- Analyse and describe the group’s strategy and structure;

- Review and describe the group’s business model, i.e., the business and decisions processes;

- Analyse the intra-group transactions with tangible and intangible property, services and financial services and the associated pricing procedures;

- Establish the various entities’ functional and risk profiles;

- Demonstrate that both, the transfer pricing procedures chosen and the resulting transfer prices comply with the arm’s length standard;

- Provide the Country-by-Country reporting.

The Master File describes the group’s business model

The group’s structure is presented based on a general description of the business model, the strategy, and the associated business and decision processes. The file specifically addresses on group level the:

- critical success factors

- high level allocation of major functions and risk across the group companies

- intangibles employed to achieve long-term economic success.

Please note that the master file covers also the group’s financing activities and related transactions as well as the group’s tax activities4. The consolidated financials are also part of the documentation.

(Reference to work steps (1.) and (2.).

The Local File demonstrates that transfer prices are at arm’s length

Intra-group transactions with tangible and intangible property, services, and financial services are accounted for in values and possibly quantities throughout the reporting period. Additionally analysing the corresponding transactions with 3rdparties (suppliers and customers) provides further context to the respective entity’s intra-group transactions. With reference to both, the group’s general business and decision processes (as provided by the master file) and the transaction flows the various entities functional and risk profile is established.

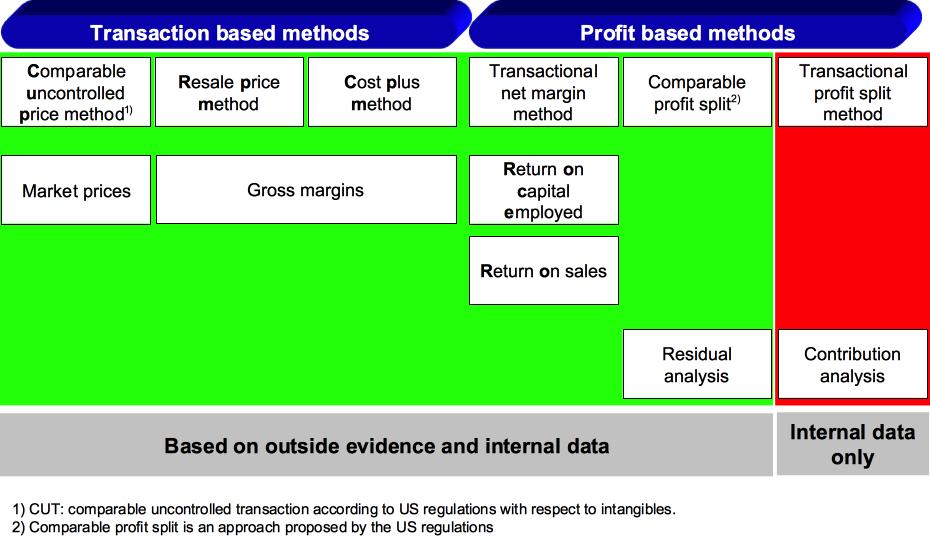

Based on these facts and circumstances, the transfer pricing method employed has to be explained. The OECD transfer pricing methods (see Exhibit 1) serve as a point of reference. Which method is appropriate depends on the respective entity’s functional and risk profile.

Integrated groups are free to choose the appropriate transfer pricing method and they can well deviate from the proposed methods as long as they are able to demonstrate that the resulting transfer prices and ultimately the allocation of profits across the group companies complies with the arm’s length principle. This requires to show that independent / uncontrolled partners would have agreed the same price under the same circumstances.

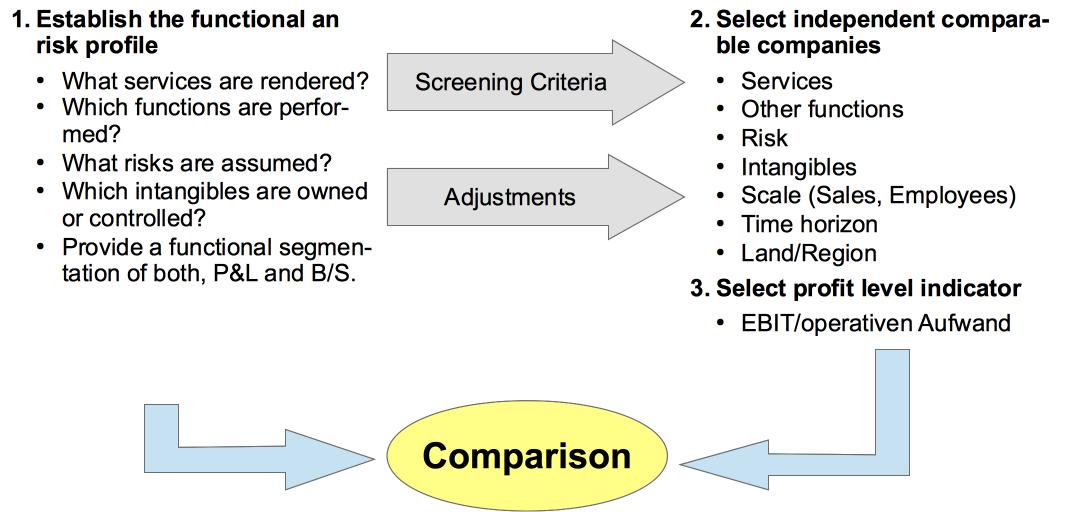

Accordingly, outside evidence / benchmarking studies need to be conducted. Purpose of such transfer pricing related studies is not to analyse champions but to take into account independent companies, rendering comparable services in uncontrolled transactions (see Exhibit 2). The screening criteria are, therefore, derived from the controlled parties’ functional and risk profiles. In addition, the integrated group has to define the region(s) and time horizon the study covers. Last but not least, it is necessary to identify functional differences and to consider appropriate adjustments should such differences have an impact on the profit level indicator considered.

Copies of contracts governing the respective intra-group transactions are also part of the documentation5. The evidence provided by the documentation shows whether or not the entities actual conduct is consistent with the contracts. Ultimately, the current practice has to comply with the arm’s length principle.

(Reference to work steps (3.), (4.) and (5.)).

The CbC-reporting provides tax administrations with a high-level group overview

Only groups with consolidated sales of more than € 750 Mio. need to produce and file the additional CbC-reporting on annual basis (beginning: fiscal year 2016); latest submission date: 31.12. (consecutive year).

The quantitative analysis required should be readily available from the ERP systems. Automatic retrieval should be possible. Please note that the data are to be aggregated on tax jurisdiction level. The following information has to be provided:

- Total revenues broken down by 3rdparties and intra-group transactions;

- Profit/loss before tax;

- Income tax paid (cash basis) and income tax accrued (current year);

- Stated Capital

- Accumulated Earnings

- Number of employees

- Tangible assets other than Cash and Cash equivalents.

It is useful to retrieve the data consistently (e.g. using the financial, i.e., P&L and B/S produced for consolidation purposes). Although the reported data are not required to reconcile with the consolidated financials it is recommended to analyse and understand their relationship. Also document the foreign exchange translation procedures employed to arrive at the data presented in the respective reporting currency.

The qualitative section requires to assign major functions performed by the constituent entities within the various tax jurisdictions. The following major functions are to be considered:

- Research & development;

- Holding or Managing intellectual property;

- Purchasing / Procurement;

- Manufacturing / Production

- Sales, Marketing, and Distribution

- Administrative, Management or Support services;

- Provision of services to unrelated parties

- Internal Group Finance

- Regulated Financial Services

- Insurance

- Holding shares or other equity instruments

- Dormant

- Other

Additional information should be provided in order to facilitate interpretation of the information provided. This applies specifically for other functions.

Significant difference between the allocation of taxable income and the resources (employees and tangible assets) employed across the various tax jurisdictions should be explained through the master file / local file documentation.

References

- OECD (2017), OECD Transfer Pricing Guidelines for Multinational Enterprises and Tax Administrations 2017, OECD Publishing, Paris

- OECD/G20 (2015), Base Erosion and Profit Shifting Project, Aligning Transfer Pricing Outcomes and Value Creation, Actions 8 – 10 2015 Final Reports, OECD Publishing, Paris

- OECD 2016, Country-by-Country-Reporting XML Schema: User Guide for Tax Administrations and Taxpayers

1 See [1.], Chapter V

2 See also [2.]

3 In Germany, the CbC reporting has to filed in the OECD defined XML-format with the Bundeszentralamt für Steuern

4 See [1.], Annex I, Chapter V

5 See [1.], Annex II to Chapter V